7 Types Of Marriage Loans in India

Marriages and grandeur celebrations are synonyms in India.

According to a report published by the Economist, the wedding industry is the fourth-largest industry in India, recording a huge spending of US$ 130 billion per year.

However, with such expenses come expectations. And with such expectations comes the requirement of loans too.

Here’s a detailed list of the types of loans you can borrow for a marriage in India.

1. Personal Loans for Marriage

One of the most popular and widely accessible options for financing weddings in India is through personal loans.

And not just that but one of the best types of personal loans is a loan against mutual funds.

Mutual fund loans have gained quite a reputation for being secure and quick, unlike traditional loans.

Just as they sound, mutual fund loans allow you to borrow funds without losing ownership over your mutual fund units.

You use your mutual fund units as collateral. This way, you continue your long-term investment plan while meeting short-term cash-strapped situations. The amount of money you can borrow depends on the total worth of your mutual fund units.

50Fin can help you get a loan against your mutual funds in a few simple steps.

Typically, your loan gets approved within 7 minutes and the amount is disbursed into your bank account in 4 business hours.

The interest rates are super affordable and as low as 10.5% per annum. Offering your mutual fund units as collateral reduces the level of risk for the lender, making it a secured loan – for both the lender and the borrower.

2. Gold Loans for Marriage

Gold has long been a symbol of wealth and security in Indian households.

Gold loans are a popular option for funding weddings because many Indian families possess significant gold jewelry, which can be used as collateral to obtain a loan.

Key features of gold loans include:

- Fair Interest Rates: Gold loans often have fairer interest rates than personal loans, typically ranging from 9% to 17%.

- Flexible Repayment Options: Many lenders offer flexible repayment options, including bullet payments, where the borrower pays the principal at the end of the loan tenure while servicing interest regularly.

- Quick Processing: Gold serves as collateral, so gold loans are usually processed quickly with minimal documentation.

- Use Case: Ideal for individuals who own gold and need to access funds quickly for wedding-related expenses. Since gold is used as collateral, the loan is less risky for lenders, resulting in lower interest rates.

3. Loan Against Fixed Deposits

If you have a fixed deposit (FD) in your name, you can take a loan against it to finance your wedding expenses.

This type of loan comes with several advantages:

Lower Interest Rates: The interest rate on loans against FDs is usually 1-2% higher than the FD interest rate, making it a cost-effective option.

No Premature Withdrawal: Borrowing against your FD allows you to continue earning interest on the deposit while utilizing the loan amount for your wedding.

Quick Disbursal: Loans against FDs are typically processed quickly since the lender already holds your deposit as collateral.

Use Case: This is a great option for individuals with significant savings in FDs who don’t want to prematurely withdraw their funds and lose out on interest income.

4. Loan Against Property (LAP) for Marriage

For individuals who own real estate, taking a loan against property is another viable option to fund wedding expenses. A loan against property (LAP) offers:

- Lower Interest Rates

- Longer Tenure

- Large Loan Amount

However, it’s important to note that since the loan is secured against property, failure to repay can result in the lender seizing the property.

Use Case: Ideal for individuals who own valuable real estate and require a significant amount of money for a grand wedding.

5. Top-Up Loan on Existing Home Loan

Top-up loans can be described as additional credit or an amount on top of your existing home loan.

Many borrowers opt for this lending option as a top-up loan doesn’t come with any end-use restrictions.

While this loan is simple and easy to avail, many banks transfer this loan linked with your current home loan to other financial institutions.

- Top-up home loans have affordable interest rates varying from 8.70 to 9.55% per annum.

- They are low-installment solutions

- The general repayment tenure lasts up to 20 years

- It requires minimal documentation and is processed rather quickly

Use Case: It is an ideal option when home loans aren’t sufficient, you can go for top-up loans to meet your financial needs.

6. Loans Against Insurance Policies

While it may come as a surprise, you can get a loan against insurance policies.

Insurance with endowment and money-back policies are highly eligible for such loans.

The reason is simple: they have maturity value.

Thus, you aren’t eligible without maturity value.

Also, if you have unit-link plans, you can’t avail loans against your insurance.

This happens because the returns aren’t fixed and are highly dependent on the market performance, much like variable loans.

It must also be noted that the only way you can opt for a loan against insurance policies is when you have received the surrender value.

Surrender value is an amount you get only when you’ve made premiums regularly for three consecutive years.

Use Case: Borrowers with insurance policies like money-back and endowment.

7. Flexi Loans

A Flexi loan is a highly flexible loan that is linked to your bank account.

The loan payments are automated through this account and you can withdraw the money whenever you want.

And the best thing about this loan is that you can get home loans with lower interest rates if you save money in this account.

Generally, the processing fee of a Flexi loan is 3.93% of the loan amount but it may vary from bank to bank.

Use Case: Anybody who is also interested in seeking a home loan.

Choosing the Right Marriage Loan for You

Selecting the right type of marriage loan depends on several factors, including your financial situation, the amount you need, and your ability to repay the loan.

Here’s a quick comparison to help you decide:

Loan Type | Interest Rates | Ideal for Borrowers |

|---|---|---|

Personal Loans | 10.5% per annum | Anybody with mutual funds |

Flexi Loans | 3.39% per annum on the entire loan amount | Anybody who is further interested in home loans |

Loan Against Fixed Deposit | 1% to 2% higher than FD interest rates | Anybody with significant savings in their FDs |

Loan Against Property | 9% per annum | Anybody who owns a real estate property |

Loan Against Insurance Policies | 10% to 15% per annum | Anybody with insurance policies like money-back and endowment policies |

Top-Up Loans | 8.70% to 9.55% per annum | Anybody who has already taken a home loan |

Gold Loans | 9% to 17% per annum | Anybody with valuable gold |

Conclusion

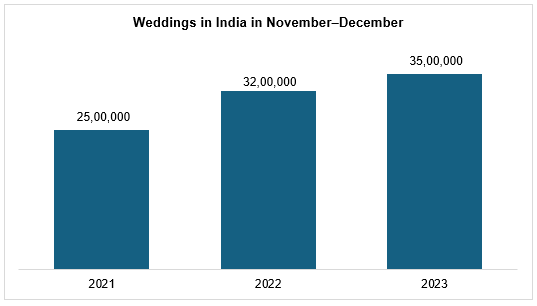

Weddings are like fairytales in India. And this is where our indulgent nature gets exposed.

While not everyone is capable of spending without bounds on their wedding, we do find ways to finance it to meet our vision.

And this is when we seek marriage loans.

There are 7 popular ways you can secure a loan to finance a wedding of your dreams, including gold loans, and loans against fixed deposits.

The best lending option, however, has to be a personal loan against your mutual funds.

Sign up with 50Fin and get your loan approved within minutes.

No delays or excessive paperwork, we promise.

Get FREE Eligibility Report

Instantly check your eligibility for Loan Against Mutual Funds

- No Minimum CIBIL Required

- 100% Digital

- 4 Working hour disbursal

Looking for Loan Against Stocks?

Recent Articles

This guide provides a comprehensive view of NSE and BSE stock market holidays for 2025, highlighting opportunities for long weekends and essential details for every trader. Use this resource to check if the Indian stock market is open today, plan for share market holidays tomorrow, or get insights into market closures throughout the year.

For Indian investors and borrowers, understanding ECS return charges and learning how to avoid them is crucial. This comprehensive guide covers everything you need to know

Investors are constantly exploring options to maximize their returns while ensuring financial flexibility. Two popular methods available to investors are ...