Blogs

This comprehensive guide covers everything you need to know about loans against mutual funds in India, including benefits, eligibility criteria, interest rates, risks, the application process, and frequently asked questions.

This guide provides a comprehensive view of NSE and BSE stock market holidays for 2025, highlighting opportunities for long weekends and essential details for every trader. Use this resource to check if the Indian stock market is open today, plan for share market holidays tomorrow, or get insights into market closures throughout the year.

For Indian investors and borrowers, understanding ECS return charges and learning how to avoid them is crucial. This comprehensive guide covers everything you need to know

Investors are constantly exploring options to maximize their returns while ensuring financial flexibility. Two popular methods available to investors are ...

From earning varied profit returns annually to taking a loan against mutual funds, here are 5 things you should know before your first mutual fund investment.

From weddings to emergencies, the issuance of types of loans has already increased by 30.94% in March 2024 in India. So how can you choose the best one?

You can harness the maximum potential of your mutual funds in many ways. Here are 5 of these ways to build a healthy mutual fund portfolio

Here’s a detailed list of the types of loans you can borrow for a marriage in India.

Apply for personal loans with mutual fund units as it is a secure lending option with affordable interest rates. Here’s more information.

Your CIBIL score is a testament to your creditworthiness. But a borrower without a CIBIL score or with a low score means that it’s difficult for you to get a loan. Here's what you can do instead.

Whether it is to settle a medical bill or pay for college tuition, you can get small personal loans for a variety of reasons. So how can you borrow a small personal loan?

Can a student borrow a personal loan? Well, it’s possible, but there are better options, like mutual fund loans. Let’s take a look at it.

Loan against ELSS mutual fund is a flexible option with several tax benefits. Here’s everything you need to know about ELSS mutual fund loans.

Mark a lien on your mutual funds to secure a loan against them, freeing you from taxes and exit charges! Here’s everything you need to know.

There are different types of personal loans with a loan against mutual funds being the most flexible one with low interest rates. Let’s take a deeper look at personal loans.

Drawing comparisons between gold loans and mutual fund loans is important before choosing an ideal lending option for yourself. Here’s a detailed analysis.

Avoid traditional loans by borrowing loans against mutual funds to meet urgent financial needs. Here’s why we recommend this zero paperwork option.

Zero paperwork loans are your answer to quick funding with little to no documentation. Explore your options here.

Loans against SIP help you secure funds without cashing your investments. Explore its flexible repayment options, lower interest rates, and more.

Mutual funds are a great investment tool, but what features of mutual funds could you seriously benefit from? Let’s find out.

Between personal loan vs mutual funds loan, what’s a more convenient option? And most importantly, which option is the best for you?

In today's fast-paced financial landscape, investing wisely has become more crucial than ever, especially for beginners.

Do you want to benefit from trending digital lending options? Here’s how you can make an informed decision considering these recent trends.

How reliable are digital lending processes over traditional lending? And should you even entertain such an option in the first place?

Are traditional loans truly the best option? Well, here's an in-depth analysis of traditional loans vs mutual fund loans...

No matter what the purpose for borrowing a loan is, one of the most convenient options is to go with an option like online loans on mutual funds

When financial needs arise, and you have invested in mutual funds, one option to consider is availing a loan against your mutual funds.

What if there was a convenient option like home loan on mutual funds? How can you benefit from an option like this?

What if there was a convenient option like home loan on mutual funds? How can you benefit from an option like this?

Do you know how to evaluate the credibility of your lender? Which platform should you be using? Let's find out.

How can you borrow a loan against mutual funds online? And how good of an idea is it really for your portfolio? Let’s find out.

Are you eligible to borrow a personal loan against your mutual fund portfolio, and should also sign up? Here’s a detailed analysis.

Loans against your mutual fund portfolio are one of the most emerging concepts among Indian audiences now and definitely something to benefit from. But how do loans against mutual funds work? Here's an in-depth guide.

What if you have you draw a loan based on mutual funds? And what are the advantages and disadvantages of doing it?

Loan on Mutual Funds: Everything You Should Know The Indian financial ecosystem has diversified quite a lot over the last

Loan on Equity Mutual Funds: Everything You Need to Know Equity mutual funds are one of those investment vehicles that

Analyze mutual fund performance in India by looking at long-term results, risk-adjusted metrics, and category comparisons. Consider the fund's philosophy, management, and fees too.

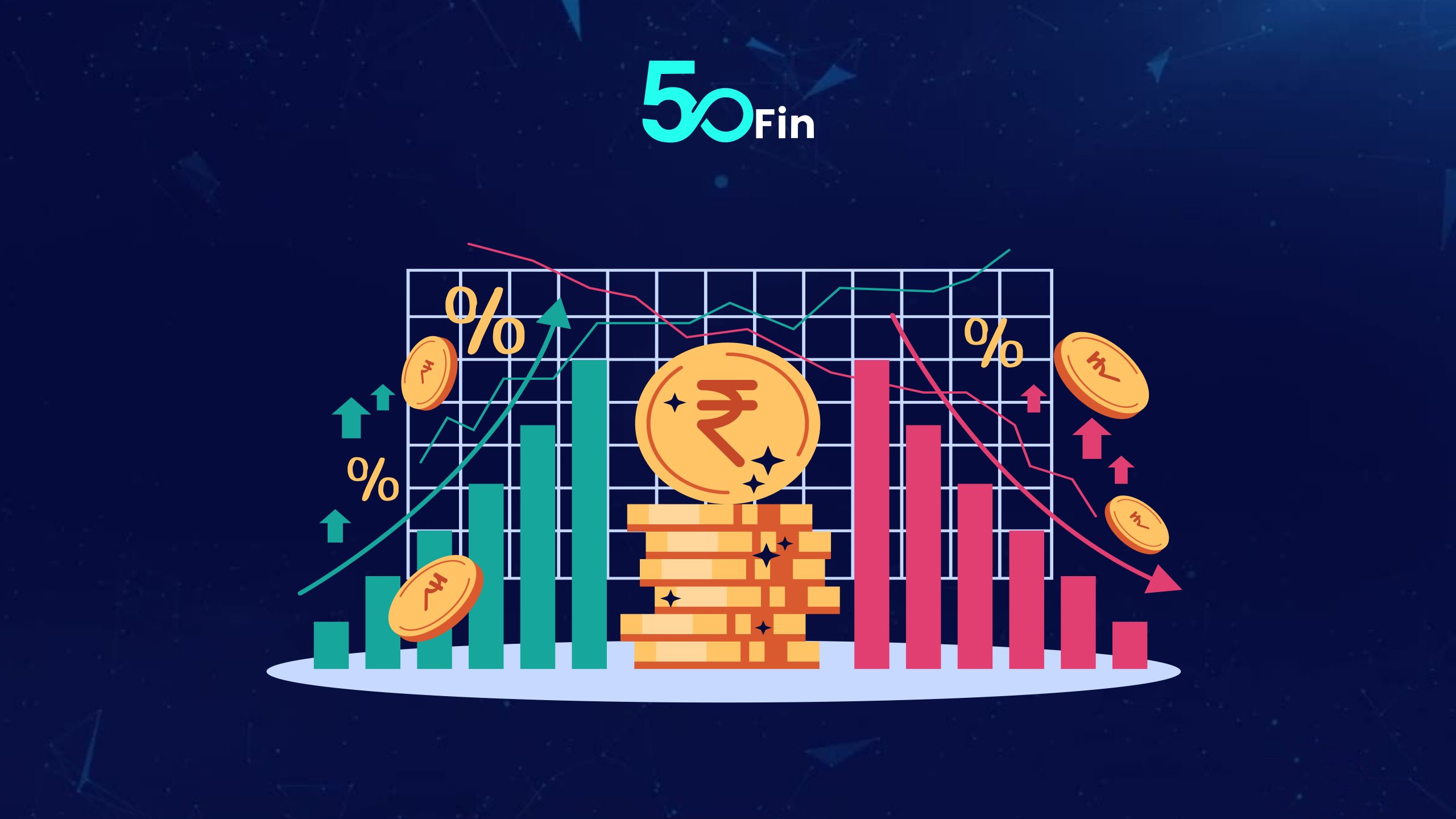

Dive into the factors that influence loan interest rates in India. Understand how economic indicators like inflation, economic growth, liquidity, and even global market trends play a crucial role in determining the rates set by the RBI.

Explores two popular investment methods for mutual funds: SIPs and lump-sum investments. Understand the pros and cons of each approach to choose the one that suits your financial goals and risk tolerance.

Explore creative budgeting, side hustles, and negotiation tactics to conquer your student loan mountain. This guide offers practical strategies to say goodbye to loans faster.

Understand the role of credit scores in your loan applications, why does it matter, and how to boost your credit score.

Explore how loans can be tax advantageous. Understand which loans qualify for tax deductions and how can you avail those tax deductions.

Understand the difference between secured and unsecured loans. Explore the pros and cons of each and which one to choose based on your risk tolerance.

Know everything about the personal loans. Explore the dos and the don'ts while considering a personal loan and understand how loan against mutual funds is a good alternative.

Explore online lending platforms - their pros and cons. understand 50Fin's loan against mutual funds with its benefits like fast approval, low rates, and high loan amounts.

Understand what debt consolidation loans are and how do they work. Explore the benefits of debt consolidation loans and why considering the same is a good idea. Guide to find the best debt consolidation loan.

Understand what interest rates are and how do they work. explore how do they affect loan repayments, how one can secure lower interest rates for loans and the long-term effects of interest on the overall cost of a loan.

Learn how to check your credit score, gather necessary documents, compare lenders, and follow up effectively. Enhance your chances of loan approval with 50fin. Get Loan against mutual funds.

Government-backed loan programs in India, covering education, agriculture, MSMEs, housing, and other areas. Get loan easily with 50Fin.

When venturing into the world of mutual fund investments, one of the crucial decisions you face is ...

50Fin and The Economic Times have come together to offer a revolutionary financial service. 50Fin & The Economic Times have partnered ...

Embrace Financial Freedom: Discover "The Smart Way" with 50Fin! Seamlessly access your Mutual Fund investments in times of need ...

Are you tired of traditional loan applications with their never-ending paperwork, credit checks, and long waiting period?

Loans against mutual funds have become a popular option for people who need quick access to funds without having to sell ...

Are you tired of the lengthy and complicated loan approval process when you need funds urgently? Do you want a loan with lower interest rates ...